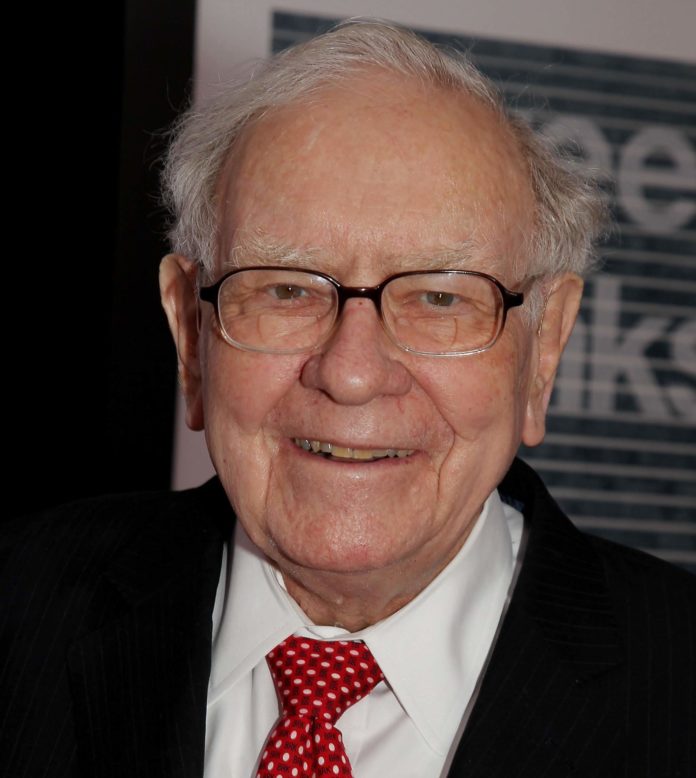

Chairman of Berkshire Hathaway Warren Buffet stated on Saturday that it would have been “catastrophic” to allow depositors in Silicon Valley Bank to lose their money after U.S. regulators took over the bank following its collapse.

In response to the bank’s failure in early March, U.S. officials made the controversial decision to protect all existing account holders including those who held deposits exceeding the $250,000 limit imposed by the Federal Deposit Insurance Corporation.

“I can’t imagine anybody saying I’d like to be the one [on] television tomorrow and explain [to] the American public why we’re keeping only $250,000 insured and we’re going to start a run on every bank in the country and disrupt the world’s financial system,” Buffett revealed during Berkshire Hathaway’s annual meeting on Saturday.

Following the start of the banking crisis, Buffett decided to pull back his banking investments. He criticized the banking sector for not sufficiently punishing the culprits of misdeeds.

Berkshire Hathaway’s banking portfolio suffered in the first quarter as a result of the financial sector’s instability, with its Bank of America stake declining by $4.7 million during the first three months of the year.